35+ should i buy down my mortgage rate

Web Current Mortgage Refinance Rates -- April 14 2021. Web Estimated monthly payment and APR calculation are based on a down payment of 25 and borrower-paid finance charges of 0862 of the base loan amount.

Buying Down Your Interest Rate Determine If It S Worth The Cost

Web Simply put a mortgage rate buy-down is upfront money often paid by the home seller builders and lenders can also front the cost to buy down the interest rate.

. Web So if you put down an extra 4 in the form of purchasing 4 points you could reduce your interest rate by a full percentage point. Web If you pay 2000 upfront for one discount point you may be able to buy your rate down to 275 or 25 basis points. Web Buying down your rate means youll pay a one-time upfront fee for a lower interest.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Borrowers can choose buydown plans with rates up to 3 lower than current mortgage rates. Use NerdWallet Reviews To Research Lenders.

Web Estimated monthly payment and APR calculation are based on a down payment of 25 and borrower-paid finance charges of 0862 of the base loan amount. Web FHA loans Backed by the Federal Housing Administration FHA an FHA loan requires only 35 percent down with a credit sore as low as 580. Ad Compare Mortgage Options Calculate Payments.

Web One mortgage point typically costs 1 of your loan total for example 3000 on a 300000 mortgage. If you have a credit. But if you want a rate of.

Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. That would drop your payment by nearly 27 per. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

From years 4-30 the buyer will pay the full 6 unless they decide to sell or refinance. Web With a 3-2-1 buydown the mortgage rate and monthly payments are lower for the first year of the loan rising in the second and third years before reaching the. Web If you paid 5000 to drop your rate from 475 to 425 you would need to make regular monthly payments for at least 68 months to save more money than you.

For example if market rates are 5 a 2-1 buydown would allow you to. Youre a conservative investor. Apply Now With Quicken Loans.

Its important not to confuse buydown. Use NerdWallet Reviews To Research Lenders. Ad Calculate Your Payment with 0 Down.

If the down payment. Each point is equal to 1 of the total. Web As of October 2021 the median home price in the US.

Read on to find out. 14 Assuming a 20 down payment you would need 80940 for a down payment plus. Take Advantage And Lock In A Great Rate.

Receive 1000 Off On Pre-Approved Loans. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Take Advantage And Lock In A Great Rate.

Web The number of points you pay should come down to how much cash you have on hand to cover the higher closing costs versus how much you want to lower your. Web You have a high mortgage rate anything around 45 of higher. Web The buyer will pay an interest rate of 5 in the third year.

With this example if you bought two points youd pay 6000. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Get The Service You Deserve With The Mortgage Lender You Trust. If the down payment. Get Your Estimate Today.

Today well discuss how to know if its a smart choice or not. Web Each mortgage discount point typically lowers your loans interest rate by 025 percent so one point would lower a mortgage rate of 4 percent to 375 percent for. Web And the rate of 6375 actually results in a lender credit which is the opposite of a buy down because you get money back to cover closing costs.

Rates Are Mixed by Maurie Backman Updated July 19 2021 - First published on April 14 2021 Image. Web That means if you purchased a home two years ago with a 30-year mortgage and 20 down the average purchase would have cost you 536551 in. Web Mortgage points are essentially prepaid interest fees that borrowers can pay upfront to lower their mortgage interest rate.

Youre nearing retirement and are in your 50s or beyond.

When Should I Buy Down My Rate An Introduction To Points Spire Financial

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

1 Difference In Mortgage Rate Matter Moneyunder30

Five Benefits Of Having A Home Custom Built Shuhayda Homes Contracting

A 50 Bps Rate Hike In June Is Virtually Guaranteed After April S Hot Inflation Reading Mortgage Rates Mortgage Broker News In Canada

What Is A Mortgage Rate Buydown

Should You Buy Down Your Mortgage Rate Pros And Cons

How Many Points Can I Buy Down From My Interest Rate Youtube

Can I Lower My Mortgage Interest Rate Without Refinancing

The Difference In Retirement Savings If You Start At 25 Vs 35

Comparison What Is A Comparison Definition Types Uses

Sales Boomerang Releases Q4 2022 Mortgage Market Opportunities Report Send2press Newswire

How Mortgage Points Work And When To Pay For Them Smartasset

Should I Buy Down My Mortgage Interest Rate Salary Optional

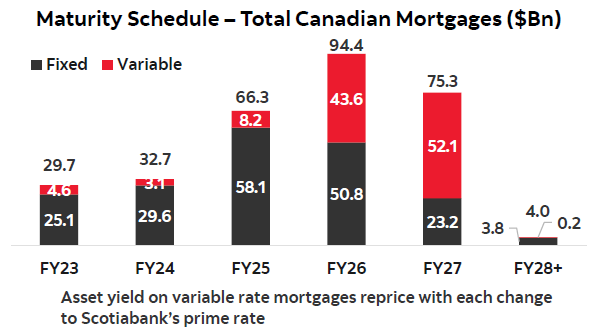

The Variable Customer Is In Good Shape Says Scotiabank Mortgage Rates Mortgage Broker News In Canada

When You Should Buy Down Your Interest Rate Zillow

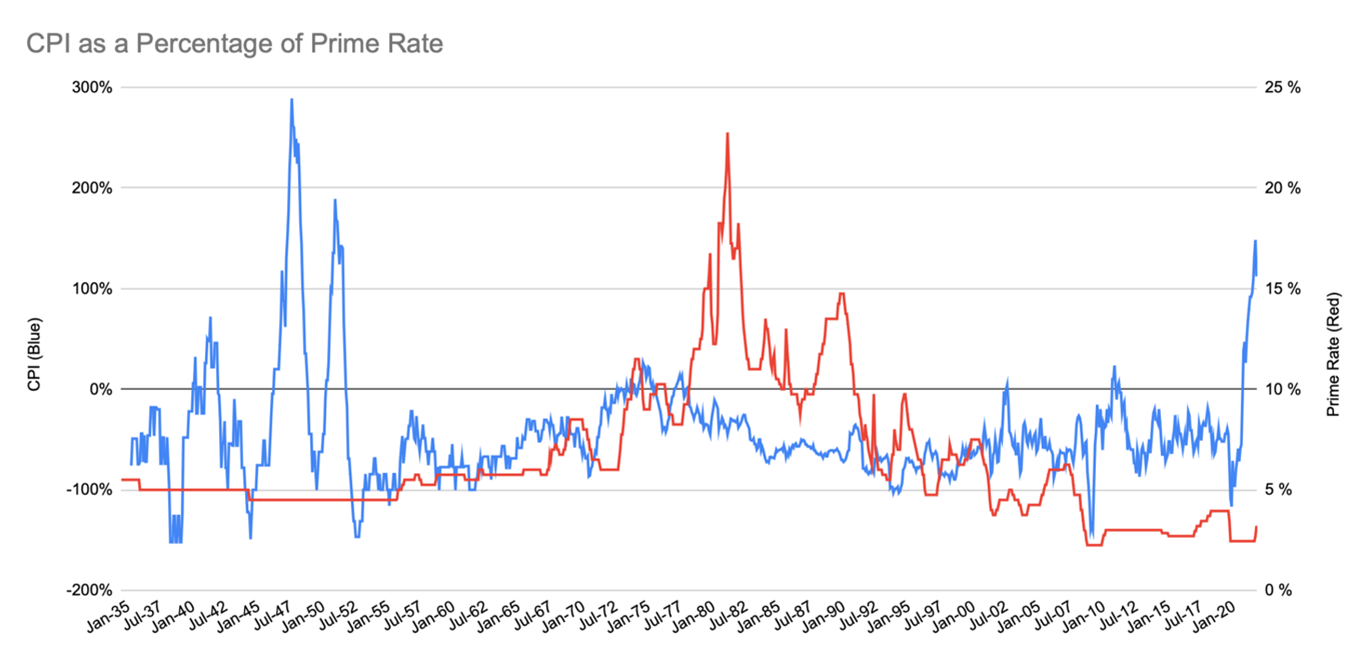

Fixed Vs Variable How Not To Lose This Mortgage Guessing Game Mortgage Rates Mortgage Broker News In Canada